“Weak governance always finds a visible culprit. It rarely confronts the root cause.”

The Americanas case, the CVM investigation, and the necessary reflection on systemic responsibility, accounting controls, auditing, and corporate governance in Brazil.

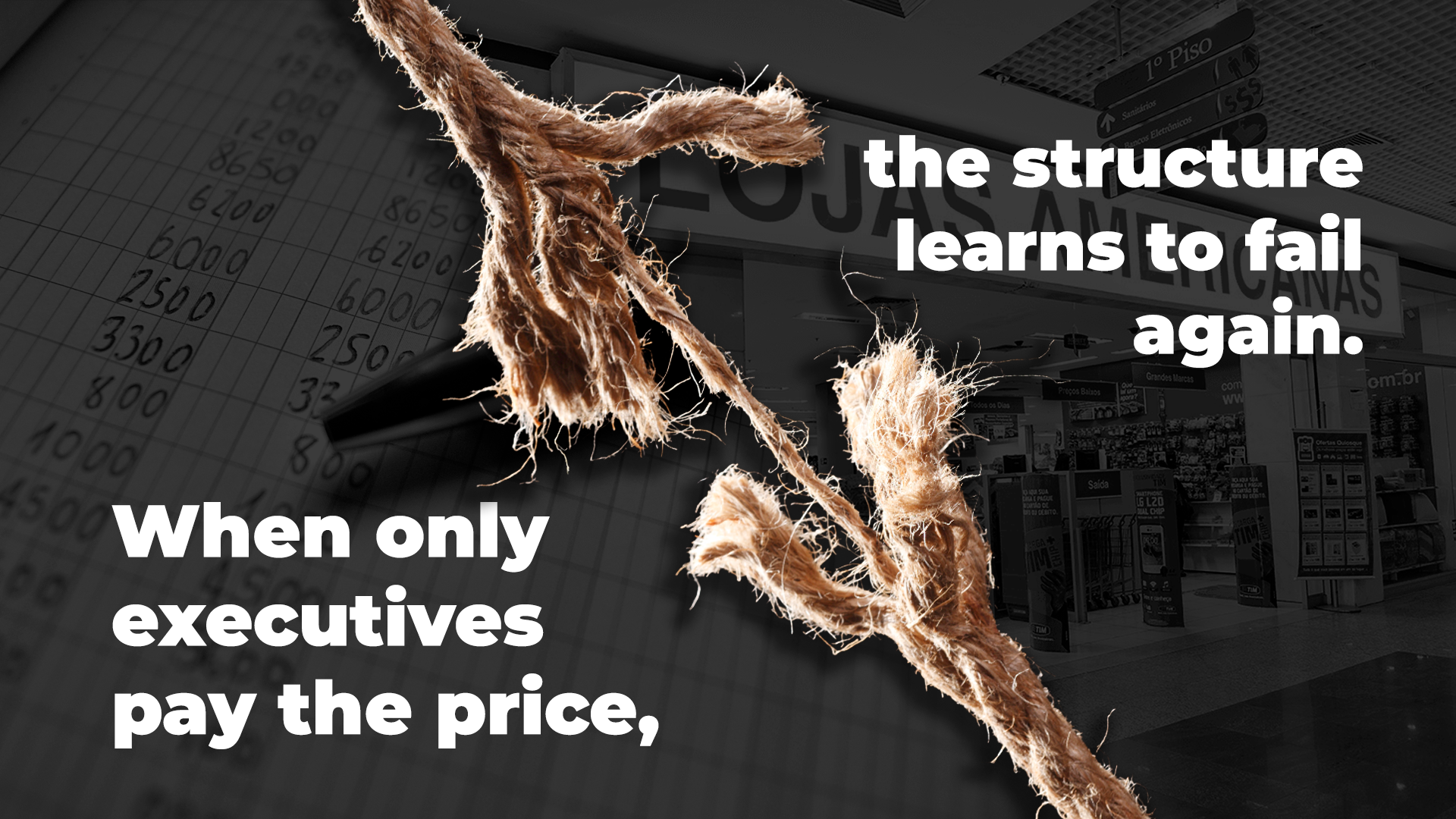

The popular saying goes, “the rope always breaks at its weakest point.” In capital markets, this phrase takes on an even harsher meaning. Pressure falls on individuals, while the structures that allowed the failure remain intact.

The recent partial conclusion of the CVM investigation into the Americanas case, holding approximately 30 executives, including the former CEO, responsible for the billion-dollar accounting fraud revealed in 2023, according to a January 2026 report by UOL, reinforces a recurring pattern in major corporate crises: the personalization of blame and the superficial examination of the system.

From a legal standpoint, it is correct that executives are held accountable. Brazilian Corporate Law, CVM regulations, and the principles of corporate governance and accountability are clear. Those who hold executive positions have fiduciary duties, responsibility for the accuracy of financial statements, and for the proper functioning of internal controls.

However, from a technical, accounting, and governance perspective, frauds of this magnitude are rarely the result of isolated individual decisions. They are almost always the consequence of structural failures, such as:

- Weak internal control systems

- Ineffective audit and risk committees

- Lack of independence and depth in external audit work

- Poor information flow between management, the board, and controlling shareholders

- Organizational culture tolerant of aggressive accounting practices

From an accounting standpoint, these issues involve revenue recognition distortions, concealment or understatement of liabilities, use of off-balance-sheet structured operations, and violations of fundamental principles such as accrual, prudence, and transparency. All of this should have been identified through formal layers of review and governance.

From a tax perspective, the impacts are equally significant: artificially inflated or reduced tax bases, improper profit distributions, hidden tax risks, and potential harm to public finances. This is not merely an investor issue, it is a systemic one.

When accountability focuses exclusively on executive management, without proportionally addressing boards of directors, controlling shareholders, independent auditors, and compliance and governance structures, an incomplete narrative is created. The market is offered quick answers and visible names, but not a genuine transformation of control and prevention models.

The risk of this approach is clear:

- Individuals are punished, flawed systems are preserved.

- Executives are replaced, but the machinery remains unchanged.

- One case is closed, the next is prepared.

Corporate governance is not a formality.

It is an architecture of protection, transparency, and integrity.

Without confronting the system that enabled the distortion, and not merely those who operated within it, the lesson remains shallow. And in the next crisis cycle, history is likely to repeat itself.

Because, in the end, the rope does not break on its own.

It snaps where it was already worn.

And that wear almost always begins long before it reaches the hands of those who are exposed.